In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even...

39 KB (5,253 words) - 16:36, 25 May 2025

Isoelastic utility (redirect from Constant relative risk aversion)

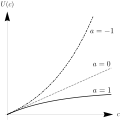

hyperbolic absolute risk aversion and at the same time is the only class of utility functions with constant relative risk aversion, which is why it is...

7 KB (894 words) - 18:26, 20 March 2025

Risk aversion is a preference for a sure outcome over a gamble with higher or equal expected value. Conversely, rejection of a sure thing in favor of...

45 KB (6,628 words) - 07:52, 8 April 2025

theory and economics, ambiguity aversion (also known as uncertainty aversion) is a preference for known risks over unknown risks. An ambiguity-averse individual...

14 KB (1,858 words) - 16:29, 25 May 2025

Expected utility hypothesis (section Risk aversion)

instead of the expected value of an outcome, accounting for risk aversion, where the risk premium is higher for low-probability events than the difference...

43 KB (5,770 words) - 18:07, 3 June 2025

The Hamilton-Jacobi-Bellman (HJB) equation is a nonlinear partial differential equation that provides necessary and sufficient conditions for optimality...

14 KB (2,050 words) - 11:37, 3 May 2025

decision theory, hyperbolic absolute risk aversion (HARA): p.39, : p.389, refers to a type of risk aversion that is particularly convenient to model...

9 KB (1,213 words) - 20:37, 6 March 2025

Equity premium puzzle (redirect from Risk free rate puzzle)

of relative risk aversion which are not required to be inversely related - a restriction imposed by the constant relative risk aversion utility function...

41 KB (5,712 words) - 00:44, 1 March 2025

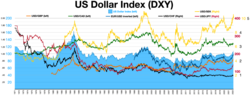

Foreign exchange market (section Risk aversion)

themselves for having caused the unsustainable economic conditions. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market...

71 KB (8,751 words) - 21:22, 23 May 2025

aversion Inequity aversion Loss aversion Risk aversion Taste aversion Work aversion Aversion may also refer to: Aversion therapy Aversion (film) Dvesha,...

700 bytes (106 words) - 14:14, 17 May 2025

Uncertainty effect (redirect from Direct risk aversion)

The uncertainty effect, also known as direct risk aversion, is a phenomenon from economics and psychology which suggests that individuals may be prone...

11 KB (1,567 words) - 12:44, 23 May 2025

framed as a loss, rather than a gain. It should not be confused with risk aversion, which describes the rational behavior of valuing an uncertain outcome...

57 KB (6,957 words) - 16:33, 25 May 2025

Jensen's inequality (section Risk aversion)

relation between risk aversion and declining marginal utility for scalar outcomes can be stated formally with Jensen's inequality: risk aversion can be stated...

31 KB (5,129 words) - 19:29, 17 May 2025

individuals are exposed to involuntary risk (a risk over which they have no control), they make risk aversion their primary goal. Under these circumstances...

3 KB (384 words) - 15:56, 9 February 2025

consideration of utility. Some economists have studied the effects of risk aversion on the bargaining solution. Compare two similar bargaining problems...

16 KB (2,002 words) - 11:09, 3 December 2024

Religiosity (section Risk-aversion)

Gijs van de Kuilen; Nathanael Vellekoop (2013). "Risk aversion and religion" (PDF). Journal of Risk and Uncertainty. 47 (2): 165–183. doi:10.1007/s11166-013-9174-8...

26 KB (2,998 words) - 13:20, 26 May 2025

This would result in a risk premium of 5%. Individual investors set their own risk premium depending on their level of risk aversion. The formula can be...

21 KB (2,749 words) - 14:49, 24 May 2025

VNM-rationality at all. This leads to a quantitative theory of monetary risk aversion. In 1738, Daniel Bernoulli published a treatise in which he posits that...

20 KB (3,314 words) - 19:43, 28 May 2025

or an option involving risk and indicated the first day of their last menstruations, and found that the subjects risk aversion preferences varied over...

198 KB (20,998 words) - 02:14, 1 June 2025

Legal risk Life-critical system Loss aversion Preventive maintenance Process risk Reputational risk Relative risk Reliability engineering Risk analysis...

87 KB (10,440 words) - 22:41, 16 May 2025

paradox in his 1961 paper, "Risk, Ambiguity, and the Savage Axioms". It is generally taken to be evidence of ambiguity aversion, in which a person tends...

16 KB (2,110 words) - 09:54, 13 October 2024

W., and E. Elisabet Rutström, “Risk Aversion in the Laboratory,” in J.C. Cox and G. W. Harrison (eds.), Risk Aversion in Experiments (Bingley, UK: Emerald...

15 KB (1,739 words) - 07:19, 28 May 2025

Exponential utility (category Financial risk modeling)

risk preference ( a > 0 {\displaystyle a>0} for risk aversion, a = 0 {\displaystyle a=0} for risk-neutrality, or a < 0 {\displaystyle a<0} for risk-seeking)...

7 KB (1,195 words) - 17:09, 26 January 2023

risk aversion substantially increased after the 2008 crisis. This encouraged individuals to divest more stock. From a macroeconomic perspective, risk...

45 KB (4,626 words) - 07:31, 5 June 2025

Inequity aversion (IA) is the preference for fairness and resistance to incidental inequalities. The social sciences that study inequity aversion include...

23 KB (3,016 words) - 18:09, 4 December 2024

Portfolio optimization (section Concentration risk)

of risk. The latter component, the cost of risk, is defined as the portfolio risk multiplied by a risk aversion parameter (or unit price of risk). For...

23 KB (2,702 words) - 11:52, 25 May 2025

Prospect theory (section Myopic Loss Aversion (MLA))

observed in economics, like the disposition effect or the reversing of risk aversion/risk seeking in case of gains or losses (termed the reflection effect)...

46 KB (6,531 words) - 16:35, 25 May 2025

consumption path will be preferred to the more volatile one. This is due to risk aversion on part of individual agents. One way to calculate how costly this greater...

14 KB (2,057 words) - 07:46, 5 April 2025

Counterfactual thinking (section Risk aversion)

Counterfactual thinking is a concept in psychology that involves the human tendency to create possible alternatives to life events that have already occurred;...

37 KB (4,854 words) - 21:50, 24 May 2025

Joseph Stiglitz (section Risk aversion)

built upon works by economists such as Robert Solow on the concept of risk aversion.[citation needed] Stiglitz and Rothschild showed three plausible definitions...

143 KB (14,041 words) - 01:46, 5 June 2025