The yield to maturity (YTM), book yield or redemption yield of a fixed-interest security is an estimate of the total rate of return anticipated to be earned...

10 KB (1,464 words) - 07:21, 5 June 2024

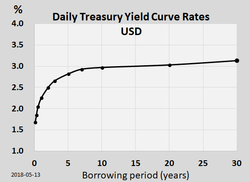

the yield curve is a graph which depicts how the yields on debt instruments – such as bonds – vary as a function of their years remaining to maturity. Typically...

45 KB (5,739 words) - 18:46, 22 April 2025

possible to define a yield spread between two different maturities of otherwise comparable bonds. For example, if a certain bond with a 10-year maturity yields...

4 KB (529 words) - 11:34, 9 May 2025

Bond valuation (section Yield to maturity)

interest rate, or required yield, or observed / appropriate yield to maturity (see below) M = {\displaystyle M=} value at maturity, usually equals par value...

18 KB (2,483 words) - 15:22, 9 April 2025

Bond (finance) (redirect from Bond yield)

yield to first call, yield to worst, yield to first par call, yield to put, cash flow yield and yield to maturity. The relationship between yield and term...

44 KB (6,197 words) - 18:24, 15 February 2025

payment and the bond's market price. The yield to maturity is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond...

10 KB (1,332 words) - 03:39, 13 October 2024

the exact same maturity date but different coupon rates will not necessarily have the same yield to maturity. This disparity is due to differing coupon...

4 KB (611 words) - 18:20, 22 April 2025

Duration (finance) (section Finite yield changes)

(time to payment), which is 1.78 years in this case. For most practical calculations, the Macaulay duration is calculated using the yield to maturity to calculate...

42 KB (6,527 words) - 15:05, 30 March 2025

bonds due to mature in ten years fell, and thus the redemption yield on those bonds increased. Deferred financing cost Rolling (finance) Maturity transformation...

3 KB (291 words) - 22:59, 28 February 2024

current yield, interest yield, income yield, flat yield, market yield, mark to market yield or running yield is a financial term used in reference to bonds...

3 KB (376 words) - 23:56, 15 February 2024

Pearl Jam recorded Yield throughout 1997 at Studio Litho and Studio X in Seattle, Washington. The album was hailed as a return to the band's early, straightforward...

43 KB (4,272 words) - 19:17, 21 December 2024

Fixed income arbitrage (section Yield Curve Arbitrage)

spread is the yield to maturity on the Treasury bond minus the fixed-rate of the swap. Swap Spread = Yield to Maturity of Swap – Yield to Maturity of Treasury...

16 KB (2,185 words) - 00:59, 18 December 2024

yield to maturity and the linearly interpolated yield for the same maturity on an appropriate reference yield curve. The reference curve may refer to...

2 KB (147 words) - 22:59, 26 June 2023

SEC yield calculation for a bond fund is essentially an annualized version of the ratio of interest and dividends per share (or yield to maturity for...

3 KB (432 words) - 12:03, 10 October 2023

Corporate bond (section High grade versus high yield)

investors to put the bond back to the issuer before its maturity date. These are called putable bonds. Both of these features are common to the High Yield market...

15 KB (1,791 words) - 03:05, 3 March 2025

the issuer of the bond to retain the privilege of redeeming the bond at some point before the bond reaches its date of maturity. In other words, on the...

4 KB (502 words) - 11:44, 24 April 2025

of a change in the yield curve that is localized at a particular maturity, and restricted to the immediate vicinity of that maturity, usually by having...

30 KB (4,871 words) - 19:24, 1 February 2024

often choose the yield to maturity on a risk-free bond issued by a government of the same currency whose risks of default are so low as to be negligible...

11 KB (1,560 words) - 17:01, 13 December 2024

than the [yield to maturity] quoted to you [when the bond was bought], actual return will then be lower than the yield to maturity quoted to you when you...

6 KB (742 words) - 12:46, 28 March 2024

with the same par value, coupon, and maturity, convexity may differ depending on what point on the price yield curve they are located. If the flat floating...

16 KB (2,090 words) - 15:09, 6 January 2025

shorter maturities generally provide lower yields than longer term bonds. To determine whether the yield curve is inverted, it is a common practice to compare...

18 KB (1,211 words) - 23:37, 10 April 2025

Corporate Bond Yield are available at the St. Louis Federal Reserve Economic Data (FRED) database. Bond Valuation — Yield To Maturity Dividend yield Bond duration...

1 KB (129 words) - 14:17, 7 November 2021

does not appropriately reflect the Yield to Maturity of the underlying asset as it approaches par value at maturity. Thirdly, the underlying asset may...

5 KB (798 words) - 06:43, 29 September 2023

eventually redeemed at that par value to create a positive yield to maturity. Regular T-bills are commonly issued with maturity dates of 4, 6, 8, 13, 17, 26 and...

29 KB (3,131 words) - 23:34, 9 May 2025

Discounting (redirect from Discount yield)

benchmark is a US Treasury bond with annual coupons) and one only has its yield to maturity, one would use an annually-compounded discount factor: D F ( T ) =...

12 KB (1,773 words) - 13:54, 1 May 2025

interest in agriculture are higher yield, quicker maturity, stability, drought tolerance etc. In proposing the term heterosis to replace the older term heterozygosis...

36 KB (4,525 words) - 22:30, 7 March 2025

the shape of the forward implied yield curves. A single currency constant maturity swap versus LIBOR is similar to a series of differential interest...

2 KB (305 words) - 21:25, 3 May 2024

realistic valuation than an interpolated yield spread based on a single point of the curve, such as the bond's final maturity date or weighted-average life. However...

4 KB (611 words) - 11:21, 27 August 2024

storage costs interest rates, expected dividends (see Dividend yield), and time to maturity (see Bond). The concept is used in assessing arbitrage opportunities...

5 KB (575 words) - 22:27, 18 May 2025

Yield curve or Yield-curve spread usually refers to the relationships among bond yields of different maturities. Yield curve or Yield-curve spread may...

662 bytes (116 words) - 16:13, 4 October 2024