A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar...

51 KB (5,721 words) - 15:52, 29 April 2024

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as...

62 KB (6,533 words) - 05:13, 21 October 2023

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for...

213 KB (19,768 words) - 07:38, 23 May 2024

types of taxes: corporate tax, individual income tax, and sales tax, including VAT and GST and capital gains tax, but does not list wealth tax or inheritance...

137 KB (5,471 words) - 16:20, 21 May 2024

tax is self assessed, and individual and corporate taxpayers in all states imposing an income tax must file tax returns in each year their income exceeds...

86 KB (8,595 words) - 23:50, 23 May 2024

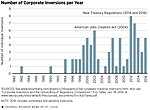

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate...

35 KB (4,500 words) - 02:12, 9 May 2024

global minimum corporate tax rate, or simply the global minimum tax (abbreviated GMCT or GMCTR), is a minimum rate of tax on corporate income internationally...

39 KB (4,278 words) - 10:27, 27 April 2024

traditional tax havens and major corporate tax havens. Corporate tax havens often serve as "conduits" to traditional tax havens. Use of tax havens results...

240 KB (24,696 words) - 18:24, 16 May 2024

in Lithuania are taxed as a general taxable income, therefore personal income tax or corporate income tax apply. As of 2021, 15% tax rate is applied for...

103 KB (13,753 words) - 08:39, 8 May 2024

TCJA, notably including individual income tax cuts, are scheduled to expire in 2025; however, its corporate tax cuts are permanent. The CBO estimated that...

171 KB (16,443 words) - 15:38, 8 May 2024

are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not...

70 KB (8,653 words) - 18:28, 11 March 2024

Corporate welfare is a phrase used to describe a government's bestowal of money grants, tax breaks, or other special favorable treatment for corporations...

24 KB (2,326 words) - 01:15, 9 January 2024

the £ symbol refer to the Pound sterling. Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies...

105 KB (10,132 words) - 16:37, 9 January 2024

potential tax rates around Europe for certain income brackets. It is focused on three types of taxes: corporate, individual, and value added taxes (VAT)....

37 KB (1,728 words) - 10:56, 11 May 2024

skilled workforce. The Netherlands has a large network of tax treaties, a low corporate income tax rate and a full participation exemption for capital gains...

23 KB (2,907 words) - 14:20, 3 August 2023

scale taxes are progressive based on brackets of annual income amounts. Most countries charge a tax on an individual's income as well as on corporate income...

110 KB (14,322 words) - 04:42, 29 May 2024

Corporate taxes in Canada are regulated at the federal level by the Canada Revenue Agency (CRA). As of January 1, 2019 the "net tax rate after the general...

33 KB (3,846 words) - 07:32, 30 May 2022

Taxation in Switzerland (redirect from Tax in Switzerland)

debts. Switzerland has a "classical" corporate tax system in which a corporation and its owners or shareholders are taxed individually, causing economic double...

38 KB (3,284 words) - 17:08, 6 January 2024

Taxation in the Republic of Ireland (redirect from List of Irish tax defaulters)

duties (12% of ETR). Corporation taxes (16% of ETR) represents most of the balance (to 95% of ETR), but Ireland's Corporate Tax System (CT) is a central part...

130 KB (14,584 words) - 22:45, 4 May 2024

personal income taxes than it did from corporate income taxes. Tax collection agreements enable different governments to levy taxes through a single...

36 KB (3,533 words) - 15:01, 14 April 2024

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response....

217 KB (22,426 words) - 19:14, 28 April 2024

the following: Corporate income tax credit Property tax abatement Sales tax exemption Payroll tax refund In Armenia, corporate income tax incentive is available...

14 KB (1,722 words) - 07:34, 24 December 2023

Taxation in Canada (redirect from Tax in canada)

tax on profit income and on capital. These make up a relatively small portion of total tax revenue. Tax is paid on corporate income at the corporate level...

61 KB (6,318 words) - 06:58, 16 November 2023

usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to...

44 KB (5,150 words) - 03:17, 26 May 2024

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of...

258 KB (26,662 words) - 19:49, 29 March 2024

Taxation in Australia (redirect from Australian corporate tax rate)

Retrieved 29 March 2018. "Reducing the corporate tax rate". Australian Taxation Office. 4 July 2017. "Changes to company tax rates". Australian Taxation Office...

32 KB (3,610 words) - 10:10, 13 May 2024

Taxation in Italy (redirect from Corporate tax in Italy)

Entrate). Total tax revenue in 2018 was 42.4% of GDP. The main earnings are income tax, social security, corporate tax and value added tax. All of these...

16 KB (2,006 words) - 19:46, 11 May 2024

Taxation in the United Arab Emirates (category Value added taxes)

added tax, corporate income tax, and excise taxes. Some emirates levy property, transfer, excise and tourism taxes. Some emirates also charge corporate taxes...

17 KB (2,013 words) - 00:45, 14 May 2024

of tax burden to non-citizens or non-residents). The tourist industry typically campaigns against the taxes. It is separate from value-added tax and...

10 KB (1,028 words) - 21:33, 11 April 2024