A short-rate model, in the context of interest rate derivatives, is a mathematical model that describes the future evolution of interest rates by describing...

27 KB (3,723 words) - 07:41, 9 April 2025

premium for such a policy Short-rate model (interest), a mathematical model that describes the future evolution of interest rates by describing the future...

400 bytes (89 words) - 18:45, 14 March 2023

model is a mathematical model describing the evolution of interest rates. It is a type of one-factor short-rate model as it describes interest rate movements...

8 KB (1,204 words) - 05:30, 4 February 2025

Black–Derman–Toy model (BDT) is a popular short-rate model used in the pricing of bond options, swaptions and other interest rate derivatives; see Lattice model (finance)...

8 KB (695 words) - 12:32, 16 September 2024

Cox–Ingersoll–Ross (CIR) model describes the evolution of interest rates. It is a type of "one factor model" (short-rate model) as it describes interest rate movements...

14 KB (1,928 words) - 17:26, 21 March 2025

C. Hull and Alan White in 1990. The model is still popular in the market today. The model is a short-rate model. In general, it has the following dynamics:...

15 KB (2,388 words) - 08:15, 26 March 2025

model is a mathematical model of the term structure of interest rates; see short-rate model. It is a one-factor model as it describes interest rate movements...

4 KB (505 words) - 12:24, 19 February 2025

chapter five of his book Market Consistency: Model Calibration in Imperfect Markets, the risk-free rate means different things to different people and...

11 KB (1,560 words) - 17:01, 13 December 2024

Mundell–Fleming model describes a small open economy. The Mundell–Fleming model portrays the short-run relationship between an economy's nominal exchange rate, interest...

25 KB (3,789 words) - 04:44, 5 April 2025

Ho-Lee model is a short-rate model widely used in the pricing of bond options, swaptions and other interest rate derivatives, and in modeling future interest...

3 KB (362 words) - 03:51, 12 January 2025

teaching. The IS–LM model shows the relationship between interest rates and output in the short run in a closed economy. The intersection of the "investment–saving"...

29 KB (3,743 words) - 22:05, 20 February 2025

linear functions of the spot rate (and potentially additional state variables). Start with a stochastic short rate model r ( t ) {\displaystyle r(t)}...

12 KB (2,599 words) - 17:05, 13 December 2024

rate List of sovereign states by central bank interest rates Macroeconomics Rate of return Short-rate model Spot rate Fisher, Irving (1907). The Rate...

38 KB (4,484 words) - 12:48, 30 April 2025

popular short-rate models, such as the Hull–White model have this degree of tractability. Thus we can value caps and floors in those models. Caps based...

12 KB (1,824 words) - 17:20, 3 December 2024

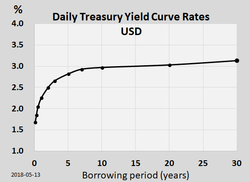

Yield curve (redirect from Term structure of interest rates)

gain or loss from changing interest rates at that point in the yield curve. Short-rate model Zero interest-rate policy Multi-curve framework 1. ^ The...

45 KB (5,739 words) - 18:46, 22 April 2025

proportional hazards model, the unique effect of a unit increase in a covariate is multiplicative with respect to the hazard rate. The hazard rate at time t {\displaystyle...

35 KB (5,760 words) - 13:31, 2 January 2025

Option (finance) (category Articles with short description)

than just the short rate. (The HJM framework incorporates the Brace–Gatarek–Musiela model and market models. And some of the short rate models can be straightforwardly...

52 KB (6,684 words) - 14:07, 29 March 2025

Asset pricing (redirect from Asset pricing model)

as to how the models listed above are applied to options on these instruments, and other interest rate derivatives, see short-rate model and Heath–Jarrow–Morton...

12 KB (1,085 words) - 20:04, 6 April 2025

discretizing either a short-rate model, such as Hull–White or Black Derman Toy, or a forward rate-based model, such as the LIBOR market model or HJM. As for...

41 KB (4,348 words) - 14:19, 16 April 2025

The IS/MP model (Investment–Savings / Monetary–Policy) is a macroeconomic tool which displays short-run fluctuations in the interest rate, inflation and...

3 KB (365 words) - 10:23, 14 March 2025

Bond (finance) (redirect from Fixed rate bond)

Government bond/Sovereign bonds Immunization (finance) Promissory note Short-rate model Penal bond Structured note Syndicated lending Market specific Brady...

44 KB (6,197 words) - 18:24, 15 February 2025

Rendleman–Bartter model (Richard J. Rendleman, Jr. and Brit J. Bartter) in finance is a short-rate model describing the evolution of interest rates. It is a "one...

2 KB (295 words) - 15:31, 4 December 2022

Monte Carlo methods for option pricing (redirect from Monte Carlo option model)

models used to simulate the interest-rate see further under Short-rate model; "to create realistic interest rate simulations" Multi-factor short-rate...

15 KB (1,667 words) - 00:51, 21 December 2024

exchange rate volatility. The key features of the model include the assumptions that goods' prices are sticky, or slow to change, in the short run, but...

9 KB (1,254 words) - 19:06, 6 April 2025

the Chen model is a mathematical model describing the evolution of interest rates. It is a type of "three-factor model" (short-rate model) as it describes...

5 KB (626 words) - 22:56, 24 May 2024

demand–aggregate supply model (also known as the aggregate supply–aggregate demand or AS–AD model) is a widely used macroeconomic model that explains short-run and long-run...

22 KB (2,850 words) - 04:14, 7 February 2025

Outline of finance (category Articles with short description)

Interest rate Risk-free interest rate Term structure of interest rates Short-rate model Vasicek model Cox–Ingersoll–Ross model Hull–White model Chen model Black–Derman–Toy...

69 KB (5,705 words) - 14:48, 7 May 2025

specification of the model, the arrows should be labeled with the transition rates between compartments. Between S and I, the transition rate is assumed to be...

108 KB (17,665 words) - 05:37, 9 May 2025

The Harrod–Domar model is a Keynesian model of economic growth. It is used in development economics to explain an economy's growth rate in terms of the...

11 KB (1,431 words) - 03:38, 23 January 2025

Monte Carlo methods in finance (category Articles with short description)

rate – the annualized interest rate at which an entity can borrow money for a given period of time; see Short-rate model. For example, for bonds, and bond...

35 KB (4,172 words) - 08:03, 29 October 2024