(PDF), is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal...

171 KB (16,443 words) - 15:38, 8 May 2024

spending cuts or changes in monetary policy that can offset their stimulative effects. Tax cuts are typically cuts in the tax rate. However, other tax changes...

32 KB (3,969 words) - 15:28, 1 May 2024

Trickle-down economics (redirect from Tax cuts for the rich)

the Reagan tax cuts, the Bush tax cuts, and the Tax Cuts and Jobs Act of 2017. Major UK examples include Liz Truss's mini-budget tax cuts of 2022. While...

46 KB (4,459 words) - 23:22, 11 May 2024

Justin Muzinich (section Tax Cuts and Jobs Act of 2017)

of the Administration's tax reform effort, ultimately resulting in the Tax Cuts and Jobs Act of 2017. Muzinich helped draft and oversee the U.S. government's...

11 KB (927 words) - 05:30, 16 April 2024

eligible substantially expanded by the Tax Cuts and Jobs Act of 2017; and finally the credit was expanded substantially and made fully available to very low-income...

82 KB (8,513 words) - 19:10, 16 April 2024

tax-cuts-and-jobs-act-change-business-taxes; TaxEDU, Tax Cuts and Jobs Act (TCJA), Tax Foundation, https://taxfoundation.org/tax-basics/tax-cuts-and-jobs-act/;...

14 KB (1,750 words) - 02:53, 8 April 2024

property taxes; (ii) personal property taxes; (iii) income, war profits, and excess profits taxes; and (iv) general sales taxes. The Tax Cuts and Jobs Act of...

32 KB (3,035 words) - 20:11, 23 April 2024

Economic policy of the Donald Trump administration (redirect from Trump tax plan)

administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act ("Obamacare"), trade protectionism, immigration...

254 KB (28,590 words) - 20:03, 20 May 2024

users of tax havens, and BEPS tools, in the world. The U.S. Tax Cuts and Jobs Act of 2017 ("TCJA"), and move to a hybrid "territorial" tax system, removed...

217 KB (22,426 words) - 19:14, 28 April 2024

Reagan tax cuts refers to changes to the United States federal tax code passed during the presidency of Ronald Reagan. There were two major tax cuts: The...

8 KB (1,074 words) - 03:03, 25 February 2024

Reconciliation Act of 2010, the Tax Cuts and Jobs Act of 2017, the American Rescue Plan Act of 2021, and the Inflation Reduction Act of 2022. Reconciliation is...

34 KB (3,695 words) - 06:07, 16 April 2024

the useful life for Section 1250 property. Recent tax law changes under the Tax Cuts and Jobs Act of 2017 (TCJA) have given a boost to cost segregation...

8 KB (1,015 words) - 15:23, 22 December 2021

capped at 25%. The income amounts ("tax brackets") were reset by the Tax Cuts and Jobs Act of 2017 for the 2018 tax year to equal the amount that would...

56 KB (6,639 words) - 04:45, 16 April 2024

Loan-out corporation (category Law and economics)

has come into place through the passing of the Tax Cuts and Jobs Act 2017 lies in end of the itemized tax deduction for unreimbursed employee expenses....

15 KB (2,196 words) - 14:22, 8 May 2024

opposed the act, although its individual provisions were generally more popular. By 2017, the law had majority support. The Tax Cuts and Jobs Act of 2017...

327 KB (30,397 words) - 00:13, 14 May 2024

529 plan (category Tax-advantaged savings plans in the United States)

along with post-secondary education costs after passage of the Tax Cuts and Jobs Act. 529 plans are named after section 529 of the Internal Revenue Code—26 U...

31 KB (4,062 words) - 01:05, 26 April 2024

corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules...

62 KB (6,533 words) - 05:13, 21 October 2023

or 28%, with a much higher exemption than the regular income tax. The Tax Cuts and Jobs Act of 2017 (TCJA) reduced the fraction of taxpayers who owed the...

71 KB (8,608 words) - 17:02, 1 January 2024

the trade embargo on Cuba should be lifted. Comer voted for the Tax Cuts and Jobs Act of 2017. After the bill passed, he said: "I am proud to support...

50 KB (3,729 words) - 16:40, 19 May 2024

California v. Texas (category Taxing and Spending Clause case law)

President Trump signed into law a large tax relief bill, the Tax Cuts and Jobs Act of 2017. Among many other tax cuts, the Act eliminated the individual mandate...

30 KB (3,171 words) - 01:23, 2 September 2023

Home mortgage interest deduction (category Income taxes)

in homeownership, decreases in mortgage debt, and welfare improvements. Because the Tax Cuts and Jobs Act of 2017 increased the standard deduction to a...

26 KB (2,798 words) - 21:59, 19 February 2024

Welch Foundation, and the Roy J. Carver Charitable Trust. In 2017, a federal endowment tax was enacted in the Tax Cuts and Jobs Act of 2017 in the form...

21 KB (901 words) - 17:11, 16 May 2024

The Tax Relief for American Families and Workers Act of 2024 is a tax bill in the 118th United States Congress (H.R. 7024) that would amend portions of...

13 KB (1,255 words) - 22:43, 16 March 2024

exemption amounts set by the Tax Cuts and Jobs Act of 2017, $11,180,000 for 2018 and $11,400,000 for 2019 again have a sunset and will expire 12/31/2025 A...

71 KB (9,305 words) - 18:17, 11 May 2024

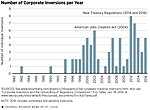

Pfizer–Allergan plc inversion, and the 2015 USD$54 billion AbbVie–Shire plc inversion), and the Tax Cuts and Jobs Act of 2017 (TCJA) further reduced the...

92 KB (9,812 words) - 21:45, 1 January 2024

companies, the U.S. Tax Cuts and Jobs Act of 2017 (TCJA) moves the U.S. to a "territorial tax" system. The TJCA's GILTI–FDII–BEAT tax regime has seen U...

258 KB (26,662 words) - 19:49, 29 March 2024

Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) Tax Relief, Unemployment...

47 KB (5,391 words) - 15:20, 18 January 2024

James R. Hines Jr. (section Tax haven research)

author on the research of tax havens, and his work on tax havens was relied upon by the CEA when drafting the Tax Cuts and Jobs Act of 2017. James Hines was...

35 KB (3,662 words) - 17:44, 14 August 2023

Taxation in the United States (redirect from United States tax law and social policy)

countries by tax rates List of countries by tax revenue as percentage of GDP Tariffs in United States history Tax Cuts and Jobs Act of 2017 Tax resistance...

119 KB (15,262 words) - 08:12, 5 May 2024

Opportunity zone (category United States tax law)

designation and investment program created by the Tax Cuts and Jobs Act of 2017 allowing for certain investments in lower income areas to have tax advantages...

9 KB (974 words) - 06:12, 28 January 2024