In finance and economics, systematic risk (in economics often called aggregate risk or undiversifiable risk) is vulnerability to events which affect aggregate...

13 KB (1,865 words) - 05:34, 20 January 2025

or market. It is also sometimes erroneously referred to as "systematic risk". Systemic risk has been associated with a bank run which has a cascading effect...

46 KB (6,040 words) - 05:27, 6 July 2025

Systematic trading (also known as mechanical trading) is a way of defining trade goals, risk controls and rules that can make investment and trading decisions...

5 KB (576 words) - 15:16, 19 June 2023

Idiosyncrasy (redirect from Idiosyncratic risk)

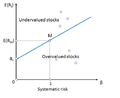

model holds, the price of a security is determined by the amount of systematic risk in its returns. Net income received, or losses suffered, by a landlord...

8 KB (894 words) - 12:39, 2 June 2025

Credit risk is the chance that a borrower does not repay a loan or fulfill a loan obligation. For lenders the risk includes late or lost interest and...

18 KB (2,048 words) - 18:39, 10 July 2025

Cardiovascular disease (redirect from Cardiovascular risk)

intake has not been found to be associated with cardiovascular risk. A 2020 systematic review found moderate quality evidence that reducing saturated...

142 KB (15,128 words) - 15:56, 17 July 2025

Sharpe ratio (redirect from Market price of risk)

ratio considers only the systematic risk of a portfolio, the Sharpe ratio considers both systematic and idiosyncratic risks. Which one is more relevant...

17 KB (2,407 words) - 02:39, 6 July 2025

Volatility risk is the risk of an adverse change of price, due to changes in the volatility of a factor affecting that price. It usually applies to derivative...

7 KB (512 words) - 07:41, 14 July 2025

of a risk. At its most basic, the perception of risk is an intuitive form of risk analysis. Intuitive understanding of risk differs in systematic ways...

87 KB (10,440 words) - 06:34, 23 June 2025

Portfolio optimization (section Concentration risk)

fundamentally different financial characteristics and have different systematic risk and hence can be viewed as separate asset classes; holding some of...

23 KB (2,702 words) - 09:41, 9 June 2025

market risk, liquidity risk, credit risk, business risk and investment risk. The four standard market risk factors are equity risk, interest rate risk, currency...

19 KB (3,281 words) - 16:17, 24 June 2025

Beta (finance) (redirect from Beta risk)

market risk of a portfolio when it is added in small quantity. It refers to an asset's non-diversifiable risk, systematic risk, or market risk. Beta is...

18 KB (2,714 words) - 13:41, 27 May 2025

Capital asset pricing model (category Financial risk modeling)

account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the...

35 KB (4,619 words) - 00:30, 17 July 2025

Modern portfolio theory (category Financial risk modeling)

Specific risk is also called diversifiable, unique, unsystematic, or idiosyncratic risk. Systematic risk (a.k.a. portfolio risk or market risk) refers...

53 KB (7,879 words) - 08:09, 26 June 2025

company's operation. Unlike systematic risk or market risk, specific risk can be diversified away. In fact, most unsystematic risk is removed by holding a...

1 KB (170 words) - 06:49, 21 October 2023

Assets and Liabilities of Commercial Banks in the United States Financial risk management § Commercial and retail banking Glass–Steagall legislation Investment...

7 KB (915 words) - 11:37, 23 June 2025

introduced by an inaccuracy inherent to the system Systematic trading, a way of defining trade goals, risk controls and rules that can make investment and...

853 bytes (124 words) - 13:54, 8 August 2023

Bank (section Capital and risk)

the market risk factors. Operational risk: risk arising from the execution of a company's business functions. Reputational risk: a type of risk related to...

72 KB (8,164 words) - 04:15, 15 July 2025

of return of an individual security as a function of systematic, non-diversifiable risk. The risk of an individual risky security reflects the volatility...

4 KB (609 words) - 14:45, 26 May 2024

Operational risk is the risk of losses caused by flawed or failed processes, policies, systems or events that disrupt business operations. Employee errors...

20 KB (2,302 words) - 16:14, 27 June 2025

relates excess return over the risk-free rate to the additional risk taken; however, systematic risk is used instead of total risk. The higher the Treynor ratio...

3 KB (413 words) - 17:26, 11 September 2024

area where model risk is more of an issue than in the modeling of the volatility smile." Avellaneda & Paras (1995) proposed a systematic way of studying...

21 KB (2,123 words) - 19:14, 8 June 2025

reports indicate that criminal actors are frequent users of neobanks.) "Strong risk of money laundering through neobanks, Swedish report reveals". Global Relay...

11 KB (982 words) - 19:14, 8 July 2025

In finance, risk factors are the building blocks of investing, that help explain the systematic returns in equity market, and the possibility of losing...

18 KB (2,356 words) - 03:08, 28 May 2025

Concentration risk is a banking term describing the level of risk in a bank's portfolio arising from concentration to a single counterparty, sector or...

5 KB (607 words) - 22:05, 23 April 2024

regulatory capital; (large) banks are also exposed to Macroeconomic systematic risk - risks related to the aggregate economy the bank is operating in (see...

108 KB (9,777 words) - 07:28, 16 July 2025

Systemically important financial institution (redirect from Systematically important financial institution)

that the tighter Basel III capital regulation, which is primarily based on risk-weighted assets, may further negatively affect the stability of the financial...

37 KB (4,277 words) - 18:01, 14 July 2025

the scam was a stock and money market broker Harshad Mehta. It was a systematic stock scam using fake bank receipts and stamp paper that caused the Indian...

23 KB (2,801 words) - 15:44, 15 May 2025

brokers Merchant brokers SEBI has enjoyed success as a regulator by pushing systematic reforms aggressively and successively. It is credited for quick movement...

36 KB (3,220 words) - 03:51, 29 June 2025

Coronary artery disease (redirect from Risk factors for coronary artery disease)

"Physical activity and risk of breast cancer, colon cancer, diabetes, ischemic heart disease, and ischemic stroke events: systematic review and dose-response...

109 KB (11,066 words) - 17:00, 16 July 2025