finance, the binomial options pricing model (BOPM) provides a generalizable numerical method for the valuation of options. Essentially, the model uses a "discrete-time"...

16 KB (2,102 words) - 03:15, 3 June 2025

Quantum finance (section Quantum binomial model)

binomial options pricing model or simply abbreviated as the quantum binomial model. Metaphorically speaking, Chen's quantum binomial options pricing model...

12 KB (1,544 words) - 11:20, 25 May 2025

analytic models: the most basic of these are the Black–Scholes formula and the Black model. Lattice models (Trees): Binomial options pricing model; Trinomial...

9 KB (1,164 words) - 16:35, 27 May 2025

where option value is the probability-weighted present value of the up- and down-nodes in the later time-step. See Binomial options pricing model § Method...

41 KB (4,348 words) - 14:19, 16 April 2025

understanding of the options pricing model, and coined the term "Black–Scholes options pricing model". The formula led to a boom in options trading and provided...

65 KB (9,560 words) - 05:29, 30 May 2025

of the binomial options pricing model. It models the dynamics of the option's theoretical value for discrete time intervals over the option's life. The...

52 KB (6,684 words) - 14:07, 29 March 2025

Trinomial tree (category Options (finance))

computational model used in financial mathematics to price options. It was developed by Phelim Boyle in 1986. It is an extension of the binomial options pricing model...

7 KB (894 words) - 19:22, 16 December 2024

development of the arbitrage pricing theory (mid-1970s) as well as for his role in developing the binomial options pricing model (1979; also known as the...

7 KB (594 words) - 04:33, 20 July 2024

the school, including the Black–Scholes model, the random walk hypothesis, the binomial options pricing model, and the field of system dynamics. The faculty...

32 KB (3,078 words) - 14:23, 18 June 2025

Binomial options pricing model for equity underlyings. ("Two-State Option Pricing". Journal of Finance 24: 1093-1110.) Hull, John C. (2003). Options,...

2 KB (295 words) - 15:31, 4 December 2022

syntactic device Binomial nomenclature, a Latin two-term name for a species, such as Sequoia sempervirens Binomial options pricing model, a numerical method...

1 KB (185 words) - 08:51, 31 July 2024

Vasicek model 1979 – John Carrington Cox; Stephen Ross; Mark Rubinstein, Option pricing: A simplified approach, Binomial options pricing model and Lattice...

34 KB (3,956 words) - 20:32, 27 May 2025

numerical extrapolation afterwards. Binomial options pricing model Trinomial tree Valuation of options Option: Model implementation Korn, Ralf; Kreer, Markus;...

3 KB (404 words) - 12:47, 9 April 2024

particularly options, and was known for his contributions to both theory and practice, especially portfolio insurance and the binomial options pricing model (also...

6 KB (526 words) - 04:13, 20 July 2024

Machine learning, more generally (see below). In pricing derivatives, the binomial options pricing model provides a discretized version of Black–Scholes...

125 KB (11,978 words) - 05:42, 25 May 2025

Mathematical finance (redirect from Derivative pricing)

relationships for options) Intrinsic value, Time value Moneyness Pricing models Black–Scholes model Black model Binomial options model Implied binomial tree Edgeworth...

23 KB (2,358 words) - 07:34, 20 May 2025

Black–Derman–Toy model (BDT) is a popular short-rate model used in the pricing of bond options, swaptions and other interest rate derivatives; see Lattice model (finance)...

8 KB (695 words) - 12:32, 16 September 2024

solutions) do not exist, while other numerical methods such as the Binomial options pricing model and finite difference methods face several difficulties and...

35 KB (4,172 words) - 05:48, 25 May 2025

an employee that carries some characteristics of financial options. Employee stock options are commonly viewed as an internal agreement providing the...

38 KB (4,755 words) - 15:56, 19 December 2024

Local volatility (section Bachelier model)

at each node in a binomial options pricing model. The tree successfully produced option valuations consistent with all market prices across strikes and...

23 KB (4,345 words) - 10:45, 15 May 2024

Reserve requirement or cash reserve ratio Binomial options pricing model or Cox Ross Rubinstein option pricing model Clinchfield Railroad Cat Righting Reflex...

1 KB (180 words) - 09:45, 26 October 2024

equivalent volatility under the CEV model with the same β {\displaystyle \beta } is used for pricing options. A SABR model extension for negative interest...

18 KB (2,483 words) - 22:26, 10 September 2024

approximate the price are available (for example Roll-Geske-Whaley, Barone-Adesi and Whaley, Bjerksund and Stensland, binomial options model by Cox-Ross-Rubinstein...

18 KB (2,567 words) - 13:46, 25 May 2025

via a (binomial) short rate tree or simulation; see Lattice model (finance) § Interest rate derivatives and Monte Carlo methods for option pricing, although...

27 KB (3,723 words) - 14:21, 24 May 2025

Rational pricing is the assumption in financial economics that asset prices – and hence asset pricing models – will reflect the arbitrage-free price of the...

26 KB (3,754 words) - 13:46, 12 May 2025

statistics, econometrics, and signal processing, an autoregressive (AR) model is a representation of a type of random process; as such, it can be used...

34 KB (5,421 words) - 03:27, 4 February 2025

asset pricing refers to a formal treatment and development of two interrelated pricing principles, outlined below, together with the resultant models. There...

12 KB (1,085 words) - 02:52, 14 May 2025

first applied to option pricing by Eduardo Schwartz in 1977.: 180 In general, finite difference methods are used to price options by approximating the...

8 KB (887 words) - 04:43, 26 May 2025

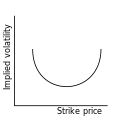

Volatility smile (redirect from Option smirk)

led to higher prices for out-of-the-money options. This anomaly implies deficiencies in the standard Black–Scholes option pricing model which assumes...

12 KB (1,758 words) - 13:51, 27 March 2025

Ho-Lee model is a short-rate model widely used in the pricing of bond options, swaptions and other interest rate derivatives, and in modeling future interest...

3 KB (362 words) - 03:51, 12 January 2025