The Heath–Jarrow–Morton (HJM) framework is a general framework to model the evolution of interest rate curves – instantaneous forward rate curves in particular...

11 KB (1,581 words) - 17:28, 28 November 2024

professor Robert A. Jarrow, co-creator of the Heath–Jarrow–Morton framework for pricing interest rate derivatives and the reduced form Jarrow–Turnbull credit...

10 KB (1,048 words) - 04:00, 26 June 2025

evolution of the short rate. The other major framework for interest rate modelling is the Heath–Jarrow–Morton framework (HJM). The distinction is that HJM gives...

52 KB (6,684 words) - 14:07, 29 March 2025

a co-creator of the Heath–Jarrow–Morton framework for pricing interest rate derivatives, a co-creator of the reduced form Jarrow–Turnbull credit risk...

5 KB (478 words) - 06:02, 17 May 2025

David Clay Heath (~1943 – 11 August 2011) was an American probabilist known for co-inventing the Heath–Jarrow–Morton framework to model the evolution...

6 KB (585 words) - 18:38, 26 November 2024

rates, and incorporate delivery- and day count conventions. The Heath–Jarrow–Morton framework is often used instead of short rates. The most basic subclassification...

7 KB (775 words) - 16:07, 23 March 2024

Cheyette model (category Heath–Jarrow–Morton framework)

interest rates intended to overcome certain limitations of the Heath-Jarrow-Morton framework. By imposing a special time dependent structure on the forward...

2 KB (135 words) - 11:09, 13 September 2024

David Heath, Robert A. Jarrow, and Andrew Morton Bond pricing and the term structure of interest rates: a new methodology (1987), Heath–Jarrow–Morton framework...

34 KB (3,956 words) - 20:32, 27 May 2025

LIBOR market model (category Heath–Jarrow–Morton framework)

the short rate or instantaneous forward rates (like in the Heath–Jarrow–Morton framework) are a set of forward rates (also called forward LIBORs), which...

5 KB (994 words) - 03:06, 16 January 2023

and other interest rate derivatives, see short-rate model and Heath–Jarrow–Morton framework. These principles are interrelated through the fundamental theorem...

12 KB (1,085 words) - 02:52, 14 May 2025

whose work is now called Itō calculus. Robert A. Jarrow, a co-creator of the Heath–Jarrow–Morton framework for pricing and credit risk model utilized in...

11 KB (1,291 words) - 17:33, 22 September 2024

is possible. The Heath-Jarrow-Morton framework was developed in the early 1991 by David Heath of Cornell University, Andrew Morton of Lehman Brothers...

4 KB (543 words) - 09:36, 18 March 2025

the (prototypical) Black–Scholes model for equities, to the Heath–Jarrow–Morton framework for interest rates, to the Heston model where volatility itself...

9 KB (1,164 words) - 16:35, 27 May 2025

HJM may refer to: Heath–Jarrow–Morton framework, a financial model Herzog–Jackson Motorsports, a NASCAR team Higman-Janko-McKay group, in group theory...

248 bytes (61 words) - 17:33, 22 September 2022

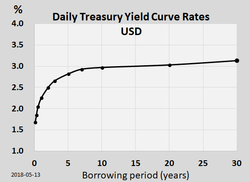

Forward curve (category Heath–Jarrow–Morton framework)

The forward curve is a function graph in finance that defines the prices at which a contract for future delivery or payment can be concluded today. For...

5 KB (648 words) - 06:33, 10 May 2025

using the Heath-Jarrow-Morton framework based on the work of researchers such as John Hull, Alan White, Robert C. Merton, Robert A. Jarrow and many others...

2 KB (338 words) - 18:54, 7 November 2023

Lattice model (finance) (category Heath–Jarrow–Morton framework)

Bibliography. Prof. Don Chance, Louisiana State University. The Heath-Jarrow-Morton Term Structure Model Archived 2015-09-23 at the Wayback Machine Grant...

41 KB (4,348 words) - 14:19, 16 April 2025

Cox–Ingersoll–Ross model, which is a modified Bessel process, and the Heath–Jarrow–Morton framework. There are also many modifications to each of these models,...

45 KB (5,739 words) - 18:46, 22 April 2025

the concept of "boundary work" David Heath, probabilist, known for developing the Heath–Jarrow–Morton framework to model the evolution of the interest...

7 KB (624 words) - 18:14, 26 April 2025

in financial markets. The other major framework for interest rate modelling is the Heath–Jarrow–Morton framework (HJM). Unlike the short rate models described...

27 KB (3,723 words) - 07:33, 25 June 2025

Management) — expert on derivative securities; co-developer of Heath-Jarrow-Morton framework and Jarrow-Turnbull model George McTurnan Kahin (Professor of Government...

84 KB (9,618 words) - 03:40, 9 March 2025

Award-nominated actress David Heath – probabilist who became world-famous for developing Heath–Jarrow–Morton framework to model evolution of interest...

11 KB (992 words) - 04:46, 15 February 2025

rate-based models LIBOR market model (Brace–Gatarek–Musiela Model, BGM) Heath–Jarrow–Morton Model (HJM) Computational finance Derivative (finance), list of derivatives...

23 KB (2,358 words) - 07:34, 20 May 2025

Finance, Vol. 29, pages: 853–864, 2005 A Markovian framework in multi-factor Heath-Jarrow-Morton models, Masaaki Kijima and Koji Inui, Journal of Financial...

4 KB (472 words) - 23:02, 23 May 2025

BGM) Heath–Jarrow–Morton Model (HJM) Cheyette model Valuation adjustments Credit valuation adjustment XVA Yield curve modelling Multi-curve framework Bootstrapping...

69 KB (5,713 words) - 12:38, 5 June 2025

short-rate model in 1977. The HJM framework originates from the work of David Heath, Robert A. Jarrow, and Andrew Morton in 1987. Simulation was first applied...

127 KB (12,140 words) - 08:34, 26 June 2025

models. PyMC3 – the Bayesian statistics and probabilistic programming framework supports AR modes with p lags. bayesloop – supports parameter inference...

34 KB (5,421 words) - 03:27, 4 February 2025

the American Finance Association; and Robert Jarrow, co-author of the Heath–Jarrow–Morton (HJM) framework for pricing interest rate derivatives. The school's...

64 KB (6,404 words) - 15:21, 24 June 2025

this was not the first raid of its type it was the most prominent. In 794, Jarrow, the monastery where Bede wrote, was attacked; in 795 Iona in Scotland was...

181 KB (25,421 words) - 13:00, 25 June 2025

Zhenyu; Kirkby, Justin L.; Nguyen, Duy (2018-04-24). "A General Valuation Framework for SABR and Stochastic Local Volatility Models". SIAM Journal on Financial...

18 KB (2,483 words) - 22:26, 10 September 2024