In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark...

7 KB (775 words) - 16:07, 23 March 2024

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular...

33 KB (3,798 words) - 13:49, 14 May 2025

an interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds...

12 KB (1,824 words) - 17:20, 3 December 2024

interest rate option is a specific financial derivative contract whose value is based on interest rates. Its value is tied to an underlying interest rate...

1 KB (125 words) - 05:01, 12 May 2024

forward rate agreement (FRA) is an interest rate derivative (IRD). In particular, it is a linear IRD with strong associations with interest rate swaps (IRSs)...

7 KB (1,005 words) - 20:29, 10 March 2025

An interest rate future is a futures contract (a financial derivative) with an interest-bearing instrument as the underlying asset. It is a particular...

9 KB (1,051 words) - 08:20, 12 July 2024

instrument (e.g. a stock or a bond), a price index, a currency, or an interest rate. Derivatives can be used to insure against price movements (hedging), increase...

90 KB (11,331 words) - 21:41, 24 May 2025

is a strictly subsidiary time market of only derivative importance. Interest is explainable by the rate of time preference among the people. To point...

67 KB (9,562 words) - 05:27, 2 June 2025

as effective annual percentage rate (EAPR), annual equivalent rate (AER), effective interest rate, effective annual rate, annual percentage yield and other...

18 KB (2,626 words) - 21:37, 19 March 2025

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The...

38 KB (4,494 words) - 22:16, 29 May 2025

A short-rate model, in the context of interest rate derivatives, is a mathematical model that describes the future evolution of interest rates by describing...

27 KB (3,723 words) - 14:21, 24 May 2025

induce any investors to hold it. In practice, to infer the risk-free interest rate in a particular currency, market participants often choose the yield...

11 KB (1,560 words) - 18:50, 24 May 2025

this phenomenon include interest rate- and currency-swaps. As regards valuation, given their complexity, exotic derivatives are usually modelled using...

4 KB (302 words) - 14:38, 23 March 2024

effective interest rate (EIR), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the percentage of interest on a loan...

5 KB (518 words) - 14:24, 19 May 2025

swap (more typically termed a cross-currency swap, XCS) is an interest rate derivative (IRD). In particular it is a linear IRD, and one of the most liquid...

25 KB (3,103 words) - 20:34, 16 May 2025

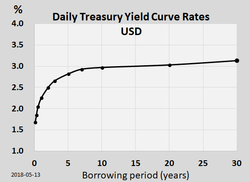

Yield curve (redirect from Term structure of interest rates)

Three-Factor Model of the Term Structure of Interest Rates and Its Application to the Pricing of Interest Rate Derivatives. Blackwell Publishers. Paul F. Cwik...

45 KB (5,739 words) - 18:46, 22 April 2025

security (MBS), or another bond with embedded options, or any other interest rate derivative or option. More loosely, the OAS of a security can be interpreted...

5 KB (683 words) - 11:28, 19 March 2025

Hull–White model (category Interest rates)

evolution of future interest rates onto a tree or lattice and so interest rate derivatives such as bermudan swaptions can be valued in the model. The first...

15 KB (2,388 words) - 21:58, 24 May 2025

SABR volatility model (category Derivatives (finance))

by practitioners in the financial industry, especially in the interest rate derivative markets. It was developed by Patrick S. Hagan, Deep Kumar, Andrew...

18 KB (2,483 words) - 22:26, 10 September 2024

Zero coupon swap (category Derivatives (finance))

interest rate derivative (IRD). In particular it is a linear IRD, that in its specification is very similar to the much more widely traded interest rate...

13 KB (2,060 words) - 12:49, 15 September 2024

in interest rates, and is defined as the second derivative of the price of the bond with respect to interest rates (duration is the first derivative)....

16 KB (2,090 words) - 18:55, 22 May 2025

trees as applied to fixed income and interest rate derivatives see Lattice model (finance) § Interest rate derivatives. The Binomial options pricing model...

16 KB (2,102 words) - 03:15, 3 June 2025

of these derivatives. They can take a similar form to fixed versus floating interest rate swaps (which are the derivative form for fixed rate bonds), but...

6 KB (716 words) - 13:03, 24 December 2024

Lattice model (finance) (category Short-rate models)

where exercise is limited to the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of...

41 KB (4,348 words) - 14:19, 16 April 2025

Corporate bond (section Derivatives)

capital structure. High grade corporate bonds usually trade at market interest rate but low grade corporate bonds usually trade on credit spread. Credit...

15 KB (1,791 words) - 12:53, 23 May 2025

In continuum mechanics, the material derivative describes the time rate of change of some physical quantity (like heat or momentum) of a material element...

14 KB (2,003 words) - 07:38, 8 April 2025

of banks. In the credit derivative market a similar concept to reference rates is used. Pay offs are not determined by a rate, but by possible events...

3 KB (376 words) - 13:56, 21 April 2024

A fixed-rate mortgage (FRM) is a mortgage loan where the interest rate on the note remains the same through the term of the loan, as opposed to loans where...

13 KB (2,086 words) - 02:59, 14 April 2025

Structured product (redirect from Interest rate-linked note)

other derivatives, except that they were prepackaged as one product. The goal was again to give investors more reasons to accept a lower interest rate on...

19 KB (2,234 words) - 14:01, 20 September 2024

Government debt (section Exchange rate risk)

fiscal measures. Government debt accumulation may lead to a rising interest rate, which can crowd out private investment as governments compete with...

36 KB (3,874 words) - 18:33, 28 May 2025