In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular...

33 KB (3,798 words) - 13:49, 14 May 2025

uncertain variable such as a benchmark interest rate, a foreign exchange rate, an index price, or a commodity price. Swaps are primarily over-the-counter contracts...

32 KB (3,961 words) - 14:29, 3 November 2024

For interest rate swaps, the Swap rate is the fixed rate that the swap "receiver" demands in exchange for the uncertainty of having to pay a short-term...

2 KB (233 words) - 13:12, 20 April 2023

In finance, a currency swap (more typically termed a cross-currency swap, XCS) is an interest rate derivative (IRD). In particular it is a linear IRD...

25 KB (3,103 words) - 20:34, 16 May 2025

FTSE MTIRS Index (category Interest rates)

Indices are designed to accurately move in direct correlation to OTC Interest Rate Swaps market with a total of 45 indices covering the USD curve from 2 years...

2 KB (352 words) - 07:04, 23 July 2024

Spread trade (section IRS (Interest rate swap) spreads)

each pegged to the USD, hence their interest rate swap markets are highly correlated to the US interest rate swap market respectively. e.g. if the SAR...

6 KB (743 words) - 15:39, 20 February 2025

an interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds...

12 KB (1,824 words) - 17:20, 3 December 2024

indexed swap (OIS) is an interest rate swap (IRS) over some given term, e.g. 10Y, where the periodic fixed payments are tied to a given fixed rate while...

7 KB (810 words) - 06:14, 12 April 2025

A basis swap is an interest rate swap which involves the exchange of two floating rate financial instruments. A basis swap functions as a floating-floating...

2 KB (319 words) - 06:44, 29 September 2023

underlying interest rate index. Examples of linear IRDs are; interest rate swaps (IRSs), forward rate agreements (FRAs), zero coupon swaps (ZCSs), cross-currency...

7 KB (775 words) - 16:07, 23 March 2024

Swap spreads are the difference between the swap rate (a fixed interest rate) and a corresponding government bond yield with the same maturity (Treasury...

2 KB (185 words) - 02:22, 16 May 2025

(finance) Swap (finance) International Swaps and Derivatives Association Credit derivatives Credit default swap Currency swap Forex swap Interest rate swap Energy...

13 KB (1,109 words) - 15:20, 15 May 2025

LCH (clearing house) (section Interest rate swaps)

As of 2012,[update] LCH cleared approximately 50% of the global interest rate swap market, and was the second largest clearer of bonds and repos in the...

14 KB (1,774 words) - 13:11, 22 May 2025

Notional amount (category Interest rates)

change and is thus referred to as notional. Contrast a bond with an interest rate swap: In a bond, the buyer pays the principal amount at issue (start),...

6 KB (982 words) - 08:20, 11 December 2024

combination of a fixed rate bond and an interest rate swap. This combination is known as an asset swap. Perpetual notes (PRN) Variable rate notes (VRN) Structured...

11 KB (1,451 words) - 03:30, 16 April 2024

maturity swap (CMS) is a swap that allows the purchaser to fix the duration of received flows on a swap. The floating leg of an interest rate swap typically...

2 KB (305 words) - 21:25, 3 May 2024

Quality spread differential (category Swaps (finance))

arises during an interest rate swap in which two parties of different levels of creditworthiness experience different levels of interest rates of debt obligations...

2 KB (376 words) - 09:32, 28 May 2025

forward rate agreement (FRA) is an interest rate derivative (IRD). In particular, it is a linear IRD with strong associations with interest rate swaps (IRSs)...

7 KB (1,005 words) - 20:29, 10 March 2025

Swaption (category Swaps (finance))

underlying swap. Although options can be traded on a variety of swaps, the term "swaption" typically refers to options on interest rate swaps. There are...

10 KB (1,377 words) - 04:02, 14 April 2025

long term. A commodity swap is similar to a fixed-floating interest rate swap. The difference is that in an interest rate swap, the floating leg is based...

2 KB (240 words) - 06:25, 17 December 2024

In finance, a zero coupon swap (ZCS) is an interest rate derivative (IRD). In particular it is a linear IRD, that in its specification is very similar...

13 KB (2,060 words) - 12:49, 15 September 2024

or "floating" rates can be reset. There are derivative products that allow for hedging and swaps between the two. However interest rates are set by the...

67 KB (9,562 words) - 05:27, 2 June 2025

making. In 2014, the firm expanded its market-making offering to interest rate swaps, one of the most commonly traded derivatives. Analysts of U.S. financial...

38 KB (3,203 words) - 06:56, 23 April 2025

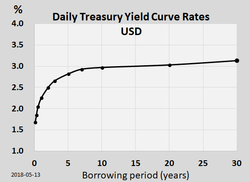

Yield curve (redirect from Term structure of interest rates)

because it is constructed using either LIBOR rates or swap rates. A LIBOR curve is the most widely used interest rate curve as it represents the credit worth...

45 KB (5,739 words) - 18:46, 22 April 2025

effective interest rate (EIR), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the percentage of interest on a loan...

5 KB (518 words) - 14:24, 19 May 2025

spreads via two separate futures orders. Forward contract Interest rate derivative Interest rate swap Mathematical finance The Fundamentals of Trading U.S...

9 KB (1,051 words) - 08:20, 12 July 2024

An Amortising swap is usually an interest rate swap in which the notional principal for the interest payments declines (i.e. is paid down) during the life...

1 KB (122 words) - 23:06, 4 February 2024

NPCs, including "interest rate swaps, currency swaps, basis swaps, interest rate caps, interest rate floors, commodity swaps, equity swaps, and similar agreements...

4 KB (582 words) - 12:44, 4 May 2025

swap Foreign exchange market Forward exchange rate Interest rate parity Overnight indexed swap Rollover (foreign exchange) Reuters Glossary, "FX Swap"...

5 KB (792 words) - 21:26, 1 November 2024

Libor scandal (section Mortgage rate manipulation)

which exchange a variable interest rate for a fixed interest rate. In a swap deal, when the interest rate rises, the swap seller pays the local government...

89 KB (8,899 words) - 14:44, 16 April 2025