The Black–Scholes /ˌblæk ˈʃoʊlz/ or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment... 63 KB (9,354 words) - 03:10, 3 April 2024 |

| Myron Samuel Scholes (/ʃoʊlz/ SHOHLZ; born July 1, 1941) is a Canadian–American financial economist. Scholes is the Frank E. Buck Professor of Finance... 12 KB (1,243 words) - 21:29, 4 April 2024 |

called "Normal Model" equivalently (as opposed to "Log-Normal Model" or "Black-Scholes Model"). One early criticism of the Bachelier model is that the probability... 4 KB (446 words) - 13:17, 13 April 2024 |

The Black model (sometimes known as the Black-76 model) is a variant of the Black–Scholes option pricing model. Its primary applications are for pricing... 5 KB (794 words) - 07:43, 22 April 2024 |

(lattice based) model of the varying price over time of the underlying financial instrument, addressing cases where the closed-form Black–Scholes formula is... 16 KB (2,061 words) - 16:31, 8 January 2024 |

0 , T ∗ ] {\displaystyle t\in [0,T^{*}]} . When dealing with the Black-Scholes model, we may equally well replace the savings account by the risk-free... 9 KB (1,616 words) - 17:34, 30 June 2023 |

Option (finance) (section Black–Scholes) produced by Black–Scholes, to the desired degree of precision. However, the binomial model is considered more accurate than Black–Scholes because it is... 52 KB (6,673 words) - 08:38, 28 March 2024 |

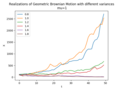

| in particular, it is used in mathematical finance to model stock prices in the Black–Scholes model. A stochastic process St is said to follow a GBM if... 14 KB (2,237 words) - 18:08, 28 February 2024 |

Stochastic volatility (section Basic model) Stochastic volatility models are one approach to resolve a shortcoming of the Black–Scholes model. In particular, models based on Black-Scholes assume that the... 16 KB (2,427 words) - 22:33, 7 May 2024 |

equivalent martingale measures is m − n {\displaystyle m-n} . In the Black-Scholes model, we have one asset and one Wiener process. The dimension of the set... 14 KB (1,797 words) - 20:45, 17 February 2024 |

Myron Scholes and Robert C. Merton, who three years later in 1997 shared the Nobel Prize in Economics for having developed the Black–Scholes model of financial... 44 KB (5,402 words) - 00:52, 10 February 2024 |

Local volatility (section Bachelier model) time t {\displaystyle t} . As such, it is a generalisation of the Black–Scholes model, where the volatility is a constant (i.e. a trivial function of S... 23 KB (4,345 words) - 08:36, 23 March 2024 |

see for example delta hedging. The Greeks in the Black–Scholes model (a relatively simple idealised model of certain financial markets) are relatively easy... 44 KB (5,388 words) - 08:00, 18 April 2024 |

but must instead be computed in some model, primarily using ATM implied volatility in the Black–Scholes model. Dispersion is proportional to volatility... 22 KB (3,261 words) - 07:00, 23 March 2024 |

Foreign exchange option (redirect from Garman–Kohlhagen model) received but FX rates move in its favor As in the Black–Scholes model for stock options and the Black model for certain interest rate options, the value of... 10 KB (1,628 words) - 05:41, 7 July 2023 |

Jump process (redirect from Jump model) model the price movements of financial instruments; for example the Black–Scholes model for pricing options assumes that the underlying instrument follows... 3 KB (276 words) - 19:45, 19 October 2023 |

| time) before and including maturity. A continuous model, on the other hand, such as Black–Scholes, would only allow for the valuation of European options... 36 KB (3,890 words) - 09:23, 2 April 2024 |

Scholes (the sch is pronounced sh or sk) may refer to: Scholes, in St Helens, Merseyside. Scholes, Greater Manchester, in Wigan Scholes, South Yorkshire... 3 KB (365 words) - 16:49, 8 December 2023 |

Binary option (section Black–Scholes valuation) payout structure." In the Black–Scholes model, the price of the option can be found by the formulas below. In fact, the Black–Scholes formula for the price... 58 KB (6,722 words) - 09:24, 29 January 2024 |

model Vasicek model Chen model Longstaff–Schwartz model LIBOR market model (Brace Gatarek Musiela model) Binomial model Black–Scholes model (geometric Brownian... 2 KB (260 words) - 23:14, 6 February 2023 |

solvency cone is the halfspace normal to the unique price vector. The Black–Scholes model assumes a frictionless market. "Frictionless Market - Investopedia"... 873 bytes (84 words) - 17:20, 17 March 2021 |

underlying instrument which, when input in an option pricing model (usually Black–Scholes), will return a theoretical value equal to the price of the option... 15 KB (2,022 words) - 02:53, 1 May 2024 |

Valuation of options (section Pricing models) analytic models: the most basic of these are the Black–Scholes formula and the Black model. Lattice models (Trees): Binomial options pricing model; Trinomial... 9 KB (1,205 words) - 13:01, 6 February 2024 |

| finance. His Bachelier model has been influential in the development of other widely used models, including the Black-Scholes model. Bachelier is considered... 22 KB (2,050 words) - 07:15, 6 May 2024 |

models. Completeness is a common property of market models (for instance the Black–Scholes model). A complete market is one in which every contingent... 5 KB (655 words) - 13:01, 9 May 2024 |

or else the Black–Scholes PDE will have to be solved numerically. One such approximation is described here. See also Black–Scholes model#American options... 6 KB (1,300 words) - 16:31, 15 January 2022 |