The Common Consolidated Corporate Tax Base (CCCTB) is a proposal for a common tax scheme for the European Union developed by the European Commission and... 20 KB (3,242 words) - 07:35, 14 August 2022 |

regarding companies, the following policies: the common consolidated corporate tax base, the common system of taxation applicable in the case of parent... 20 KB (2,753 words) - 13:07, 14 April 2024 |

is done from a consolidated fund. Hypothecated taxes have a long history. One of the first examples of earmarking was ship money, the tax paid by English... 8 KB (1,102 words) - 14:26, 21 February 2023 |

of tax burden to non-citizens or non-residents). The tourist industry typically campaigns against the taxes. It is separate from value-added tax and... 10 KB (1,028 words) - 21:33, 11 April 2024 |

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar... 51 KB (5,721 words) - 15:52, 29 April 2024 |

Taxation in Bangladesh (section Corporate tax rate) and services. The tax law imposes income tax at 25 percent on listed entities and 32.5 percent for non-listed entities. Corporate tax rate changes announced... 5 KB (690 words) - 13:27, 20 April 2024 |

expatriation tax or emigration tax is a tax on persons who cease to be tax-resident in a country. This often takes the form of a capital gains tax against... 16 KB (1,930 words) - 18:30, 26 April 2024 |

Income tax in the Netherlands (personal, rather than corporate) is regulated by the Wet inkomstenbelasting 2001 (Income Tax Law, 2001). The fiscal year... 17 KB (1,955 words) - 08:52, 14 April 2024 |

Taxable income of each member is computed as if no consolidated return were filed, with the exception of certain items computed on a consolidated basis... 26 KB (3,182 words) - 19:49, 20 August 2022 |

relative to their resources (the demographics of the tax base). In other words, if the activity being taxed is more likely to be carried out by the poor and... 32 KB (3,778 words) - 08:55, 9 May 2024 |

a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is... 15 KB (1,417 words) - 16:11, 16 February 2024 |

| Taxation in Sweden (redirect from Tax in Sweden) tax. The employer makes monthly preliminary deductions (PAYE) for income tax and also pays the payroll tax to the Swedish Tax Agency. The income tax is... 19 KB (2,018 words) - 20:16, 29 April 2024 |

Taxation in Indonesia (section Corporate Income Tax) Taxation in Indonesia includes income tax, value added tax (goods and sales tax) and carbon tax. Indonesian taxation is based on Article 23A of UUD 1945 (1945... 16 KB (2,385 words) - 18:18, 19 August 2023 |

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property... 57 KB (6,815 words) - 08:00, 27 April 2024 |

amnesty but do not take it. Tax amnesty is one of voluntary compliance strategies to increase tax base and tax revenue. Tax amnesty is different from other... 30 KB (3,632 words) - 03:34, 27 February 2024 |

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale... 103 KB (13,753 words) - 08:39, 8 May 2024 |

| alphabetically, with total tax revenue as a percentage of gross domestic product (GDP) for the listed countries. The tax percentage for each country... 19 KB (98 words) - 18:14, 7 May 2024 |

Taxation in Australia (redirect from Australian corporate tax rate) company tax rate of 27.5%. From 2017/18, corporate entities eligible for the lower tax rate have been known as "base rate entities". The small business threshold... 31 KB (3,471 words) - 00:21, 27 January 2024 |

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the... 25 KB (3,427 words) - 10:54, 21 April 2024 |

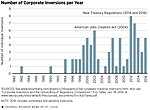

tax regimes and move to a hybrid "territorial" tax system, and proposed EU Digital Services Tax regime, and EU Common Consolidated Corporate Tax Base)... 241 KB (24,843 words) - 14:25, 8 May 2024 |

amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage. Average tax rates is used to measure tax burden of... 20 KB (2,771 words) - 13:33, 29 April 2024 |

consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on consumption. Consumption taxes are... 26 KB (3,370 words) - 06:00, 22 December 2023 |

Taxation in Pakistan (redirect from Tax in Pakistan) considered as a normal tax year for Pakistan tax law purposes. Corporate Income tax rates Currently, the Corporate Income tax rate is 29% for tax year 2019 and... 8 KB (991 words) - 11:22, 15 November 2023 |

Taxation in Israel (section Corporate tax) approved a series of amendments to Israel's tax law. Among the amendments were the raising of the corporate tax rate from 24% to 25% and possibly 26% in... 14 KB (1,467 words) - 14:32, 6 April 2024 |