Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for... 213 KB (19,767 words) - 15:39, 26 April 2024 |

traditional tax havens and major corporate tax havens. Corporate tax havens often serve as "conduits" to traditional tax havens. Use of tax havens results in... 241 KB (24,843 words) - 14:25, 8 May 2024 |

A data haven, like a corporate haven or tax haven, is a refuge for uninterrupted or unregulated data. Data havens are locations with legal environments... 4 KB (358 words) - 21:20, 15 January 2024 |

| Delaware (redirect from Delaware as a corporate haven) the turn of the 20th century, Delaware has become an onshore corporate haven whose corporate laws are deemed appealing to corporations; over half of all... 144 KB (13,104 words) - 23:12, 10 May 2024 |

| Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response.... 217 KB (22,426 words) - 19:14, 28 April 2024 |

Tax Justice Network (section Corporate Tax Haven Index) centre Corporate haven Tax haven "Happy Birthday Tax Justice Network". TJN. 9 November 2012. "Report Says U.S. Is World's Second-Biggest Tax Haven". Bloomberg... 10 KB (809 words) - 23:41, 29 March 2024 |

| Delaware General Corporation Law (category United States corporate law) jurisdiction in United States corporate law. Delaware is considered a corporate haven because of its business-friendly corporate laws compared to most other... 12 KB (1,374 words) - 05:22, 19 April 2024 |

| Corporation (redirect from Corporate entity) Corporate group Corporate haven Corporate propaganda Corporate warfare Corporate welfare Corporation sole Corporatism Corporatization Decentralized autonomous... 50 KB (6,162 words) - 17:41, 24 April 2024 |

countries without paying Dutch corporate tax. Minister Van der Stee admitted that the country was internationally known as a tax haven, but refused to act, arguing... 23 KB (2,907 words) - 14:20, 3 August 2023 |

| Base erosion and profit shifting (category Corporate tax avoidance) which in most instances may lead to base erosion of the tax base. Corporate tax havens have some of the most advanced IP tax legislation in their statute... 68 KB (7,501 words) - 00:14, 30 April 2024 |

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar... 51 KB (5,721 words) - 15:52, 29 April 2024 |

requires |journal= (help) Leslie Waynejune: How Delaware Thrives as a Corporate Tax Haven, The New York Times, June 30, 2012 Neate, Rupert (2016-04-25). "Trump... 11 KB (1,088 words) - 02:10, 11 February 2023 |

| Nevada corporation (category United States corporate law) United States corporate law. Nevada, like Delaware (see Delaware General Corporation Law), is well known as a state that offers a corporate haven. Many major... 9 KB (1,174 words) - 19:53, 16 February 2023 |

defensive measures. European company law Common Consolidated Corporate Tax Base Corporate haven Text was copied from this source, which is © European Union... 16 KB (1,145 words) - 21:42, 22 April 2024 |

| Conduit and sink OFCs (category Corporate tax avoidance) of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens. Traditional methods for identifying tax havens analyse tax and... 61 KB (5,550 words) - 09:50, 7 September 2023 |

Asset protection ATTAC NGO's criticism of tax haven and underground economy Corporate haven Corporate Inversion Free port Free economic zone International... 10 KB (1,495 words) - 02:15, 15 March 2024 |

| Panama Papers (section Tax havens) were created by, and taken from, former Panamanian offshore law firm and corporate service provider Mossack Fonseca, and compiled with similar leaks into... 158 KB (14,413 words) - 01:45, 18 April 2024 |

| Tax Havens (2015), Zucman is known for his research on tax havens and corporate tax havens. Zucman's research has found that the leading corporate tax... 22 KB (2,217 words) - 14:39, 6 May 2024 |

| Taxation in Jersey (redirect from Jersey tax haven) the Corporate Tax Heaven Index ranked Jersey 8th for 2021 with a haven score (a measure of the jurisdiction's systems to be used for corporate tax abuse)... 28 KB (3,154 words) - 23:44, 25 February 2024 |

| Shell corporation (redirect from Corporate shell) defining feature of shell companies due to the loopholes in the global corporate transparency initiatives. It may hold passive investments or be the registered... 22 KB (2,617 words) - 15:33, 4 May 2024 |

The Republic of Panama is one of the oldest and best-known tax havens in the Caribbean, as well as one of the most established in the region. Panama has... 17 KB (1,829 words) - 12:24, 9 May 2024 |

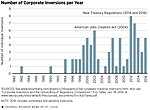

| Tax inversion (redirect from Corporate Inversion) these inversions were mostly "naked inversions" where the corporate re-domiciled to a tax haven in which they had no existing business, and included: Ingersoll-Rand... 92 KB (9,812 words) - 21:45, 1 January 2024 |

| Offshore financial centre (redirect from Offshore tax haven) banks. Corporate tax haven Financial centre Ireland as a tax haven Market manipulation Panama Papers Pandora Papers Paradise Papers Tax haven United States... 73 KB (8,644 words) - 03:36, 2 May 2024 |

Expatriation tax (redirect from Corporate exit tax) Corporate Tax inversion Transfer mispricing Base erosion and profit shifting (BEPS) Double Irish Dutch Sandwich Single Malt CAIA Locations Tax havens... 16 KB (1,930 words) - 18:30, 26 April 2024 |

James R. Hines Jr. (section Tax haven research) economist and a founder of academic research into corporate-focused tax havens, and the effect of U.S. corporate tax policy on the behaviors of U.S. multinationals... 35 KB (3,662 words) - 17:44, 14 August 2023 |

Corporate Tax inversion Transfer mispricing Base erosion and profit shifting (BEPS) Double Irish Dutch Sandwich Single Malt CAIA Locations Tax havens... 3 KB (235 words) - 01:54, 8 April 2024 |

Investment in Serbia" (PDF). 2022. Woolsey, Matt; Eaves, Elisabeth. "Tax Havens Of The World". Forbes. "Taxes". Archived from the original on 21 July 2015... 57 KB (6,815 words) - 08:00, 27 April 2024 |