Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as...

62 KB (6,533 words) - 05:13, 21 October 2023

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar...

51 KB (5,721 words) - 15:52, 29 April 2024

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property...

119 KB (15,262 words) - 08:12, 5 May 2024

U.S. tax accounting refers to accounting for tax purposes in the United States. Unlike most countries, the United States has a comprehensive set of accounting...

5 KB (565 words) - 01:25, 20 August 2023

In addition to federal income tax collected by the United States, most individual U.S. states collect a state income tax. Some local governments also impose...

86 KB (8,571 words) - 20:12, 17 May 2024

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as...

139 KB (14,297 words) - 19:05, 16 May 2024

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for...

213 KB (19,768 words) - 20:45, 17 May 2024

The global minimum corporate tax rate, or simply the global minimum tax (abbreviated GMCT or GMCTR), is a minimum rate of tax on corporate income internationally...

39 KB (4,278 words) - 10:27, 27 April 2024

taxation, most notably the United States and Germany in the Financial Secrecy Index ("FSI") rankings, can be featured in some tax haven lists, they are...

240 KB (24,696 words) - 18:24, 16 May 2024

severance taxes ^ As of July 1, 2012 State taxes: Sales taxes in the United States State income tax Federal: Income tax in the United States Federal tax revenue...

33 KB (492 words) - 21:38, 18 July 2022

The United States "is effectively the biggest tax haven in the world" Andrew Penney, Rothschild & Co. In 2010, the United States implemented the Foreign...

11 KB (1,088 words) - 01:45, 18 May 2024

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that...

70 KB (8,653 words) - 18:28, 11 March 2024

employed by firms based in the United States in order to reduce their taxes owed through the use of international corporate acquisitions. These include...

17 KB (2,020 words) - 17:13, 9 February 2023

United States Contingent workforce Corporate tax in the United States E-lancing Federal Insurance Contributions Act tax Freelance marketplace General contractor...

21 KB (2,432 words) - 13:35, 29 March 2024

local governments in the United States impose a property tax, also known as a millage rate, as a principal source of revenue. This tax may be imposed on...

48 KB (6,336 words) - 19:38, 10 March 2024

groups in each country and sub-national unit. The list focuses on the main types of taxes: corporate tax, individual income tax, and sales tax, including...

138 KB (5,475 words) - 06:24, 17 May 2024

added tax, corporate income tax, and excise taxes. Some emirates levy property, transfer, excise and tourism taxes. Some emirates also charge corporate taxes...

17 KB (2,013 words) - 00:45, 14 May 2024

Obama's tax reform proposals are highlighted in his administration's 2013 United States federal budget proposal and in a framework for corporate and international...

15 KB (1,505 words) - 01:47, 28 July 2023

article, the term "pound" and the £ symbol refer to the Pound sterling. Corporation tax in the United Kingdom is a corporate tax levied in on the profits...

105 KB (10,132 words) - 16:37, 9 January 2024

inheritance taxes began after 1900, while the states (but not the federal government) began collecting sales taxes in the 1930s. The United States imposed...

55 KB (7,265 words) - 15:21, 16 November 2023

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state...

168 KB (19,548 words) - 00:33, 7 May 2024

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency (California...

13 KB (1,735 words) - 16:26, 9 February 2024

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred...

71 KB (9,305 words) - 18:17, 11 May 2024

The United States Tax Court (in case citations, T.C.) is a federal trial court of record established by Congress under Article I of the U.S. Constitution...

95 KB (4,036 words) - 20:15, 9 May 2024

Corporate welfare is a phrase used to describe a government's bestowal of money grants, tax breaks, or other special favorable treatment for corporations...

24 KB (2,326 words) - 01:15, 9 January 2024

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report...

48 KB (6,323 words) - 01:54, 27 April 2024

infrastructure. Corporate tax incentives can be raised at federal, state, and local government levels. For example, in the United States, the federal tax code provides...

14 KB (1,722 words) - 07:34, 24 December 2023

tax is a government levy (tax) charged by some US states to certain business organizations such as corporations and partnerships with a nexus in the state...

4 KB (476 words) - 15:17, 15 January 2023

income taxes, both personal and corporate income taxes, are levied under the provisions of the Income Tax Act. Provincial and territorial income taxes are...

36 KB (3,533 words) - 15:01, 14 April 2024

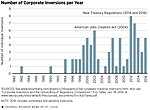

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024