Dividend stripping is the practice of buying shares a short period before a dividend is declared, called cum-dividend, and then selling them when they... 8 KB (1,041 words) - 13:57, 4 February 2024 |

| CumEx-Files (section Danish dividend scandal) than €12 billion to facilitate his alleged tax arbitrage scheme. Dividend stripping Sanjay Shah "Cum-Ex trading scandal in Germany – A huge challenge... 14 KB (1,159 words) - 16:45, 29 February 2024 |

| not tax free. Further, Indian tax laws include provisions to stop dividend stripping.[citation needed] Historically, investors were given share certificates... 6 KB (721 words) - 11:42, 11 May 2024 |

for the company. Asset stripping is a highly controversial topic within the financial world. The benefits of asset stripping generally go to the corporate... 8 KB (968 words) - 03:14, 5 May 2024 |

2023 to April 2024 tax year. Corporate tax Dividend stripping, on buying shares to access dividends Dividend tax fr:Avoir fiscal (in French) "Tax Laws... 18 KB (2,541 words) - 02:46, 21 April 2024 |

finance, a dividend future is an exchange-traded derivative contract that allows investors to take positions on future dividend payments. Dividend futures... 12 KB (1,447 words) - 21:42, 30 March 2023 |

proposed to reform dividend imputation or franking credits. Corporate tax Dividend stripping, on buying shares to access dividends Dividend tax fr:Avoir fiscal... 22 KB (3,220 words) - 10:55, 16 August 2022 |

| suspected of evading 40 million euros ($47 million) in taxes via dividend stripping, also known as "cum-ex" transactions". The investigation also extends... 27 KB (2,653 words) - 23:59, 30 April 2024 |

Income Trust, which combined income from a high yield bond with a stock dividend. Beginning in 2003 this concept was expanded to the U.S. when "Income Deposit... 1 KB (212 words) - 12:48, 24 October 2022 |

Eisner v. Macomber (category Dividends) Supreme Court that is notable for the following holdings: A pro rata stock dividend where a shareholder received no actual cash or other property and retained... 18 KB (2,422 words) - 16:07, 21 December 2023 |

2018 to combat large-scale tax evasion and avoidance schemes through dividend stripping in the wake of the CumEx Files revelations. She was defeated in the... 6 KB (565 words) - 15:36, 8 October 2023 |

Barwick - Concerning the tax position of company owners who sold to a dividend stripping operation Queensland v Commonwealth (1977) (Second Territory Senators'... 94 KB (268 words) - 04:36, 8 April 2024 |

promoter paid the owners for undistributed profits was similar to a dividend strip operation. In any case the amount the promoter paid was a tax deduction... 10 KB (1,219 words) - 01:12, 28 February 2024 |

TSX: ZDV – BMO Canadian Dividend ETF TSX: ZPR – BMO S&P/TSX Laddered Preferred Share Index ETF TSX: ZWC – BMO Canada High Dividend Covered Call TSX: ZWE... 71 KB (3,707 words) - 20:08, 8 March 2024 |

com. Retrieved 18 May 2023. "Jindal Stainless Announces Special Interim Dividend". livemint.com. Retrieved 11 May 2023. "Company History:Jindal Stainless"... 8 KB (568 words) - 09:03, 19 January 2024 |

Reckert, Clare M. (26 August 1977). Esmark Profit Up 14.3% in Quarter; Dividend Raised, The New York Times ("The processed meats company through its sales... 2 KB (280 words) - 00:28, 21 February 2024 |

| Sarah Jaffe (redirect from The Dividends) ended up forming a group called The Dividends. The name came from the idea of distribution of profits. The Dividends project resulted in an EP called Far... 31 KB (2,921 words) - 19:25, 2 March 2024 |

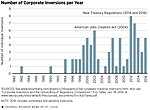

| Tax inversion (redirect from Earnings stripping) "earnings stripping" common when companies invert. Jim A. Seida; William F. Wempe (December 2004). "Effective Tax Rate Changes and Earnings Stripping Following... 92 KB (9,812 words) - 21:45, 1 January 2024 |

1935 and restored it to profitability. Dunn's policy of never paying a dividend to stockholders, coupled with extensive modernization and expansion during... 12 KB (1,391 words) - 19:44, 19 March 2024 |

Members are also eligible to receive a patronage "dividend" on qualifying purchases; this dividend is issued as store credit, not redeemable in currency... 31 KB (3,217 words) - 02:10, 5 May 2024 |

| company was dissolved in 1874 under the terms of the East India Stock Dividend Redemption Act enacted one year earlier, as the Government of India Act... 118 KB (12,335 words) - 14:49, 2 May 2024 |

purposes. Widow-and-orphan stock: a stock that reliably provides a regular dividend while also yielding a slow but steady rise in market value over the long... 9 KB (1,050 words) - 11:43, 15 January 2024 |

capital Modigliani–Miller theorem Hamada's equation Dividend policy Dividend Dividend tax Dividend yield Modigliani–Miller theorem Corporate action (Strategic)... 68 KB (5,679 words) - 08:02, 7 May 2024 |

– Musical Director I Dood It (1943) – Musical Director Father's Little Dividend (1951) – Conductor The Courtship of Eddie's Father (1963) David Robert... 479 KB (43,595 words) - 03:12, 11 May 2024 |