Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes)... 27 KB (3,937 words) - 13:23, 27 March 2024 |

Tax treaty (redirect from Double taxation treaty) called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such... 23 KB (3,032 words) - 09:41, 8 January 2024 |

Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same... 124 KB (10,481 words) - 20:31, 5 May 2024 |

law scholars. Moreover, double taxation by several cantons is constitutionally prohibited, as is a confiscatory rate of taxation. All people resident in... 38 KB (3,284 words) - 17:08, 6 January 2024 |

Direct tax (redirect from Direct taxation) States have taken measures to prevent tax avoidance and double taxation. EU direct taxation covers, regarding companies, the following policies: the... 20 KB (2,753 words) - 13:07, 14 April 2024 |

Roth IRA (section Double taxation) possible that tax laws may change by the time one reaches retirement age. Double taxation may still occur within these tax sheltered investment plans. For example... 32 KB (4,495 words) - 20:25, 14 April 2024 |

| Conference Centre in St. Michael, Barbados, George Brizan signed the Double Taxation Relief (CARICOM) Treaty on behalf of the Government of Grenada. This... 81 KB (7,733 words) - 14:48, 13 April 2024 |

aim to avoid both double taxation and double non-taxation of individuals and companies. The basic structure of the double taxation agreements which Germany... 63 KB (8,199 words) - 21:07, 6 May 2024 |

Income tax (redirect from Income taxation) generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type... 44 KB (5,150 words) - 16:37, 8 March 2024 |

| Michael, Barbados, representatives of eight countries signed the Double Taxation Relief (CARICOM) Treaties 1994. The countries which were represented... 134 KB (13,262 words) - 19:09, 1 May 2024 |

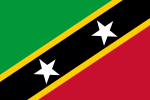

| representative of St. Kitts and Nevis Kennedy Simmons signed the Double Taxation Relief (CARICOM) Treaty 1994, on 6 July 1994. The representatives of... 66 KB (5,921 words) - 02:15, 27 April 2024 |

dividends paid to shareholders were exempt from taxation, as such tax was considered a form or double taxation on money earned by companies and subject to... 51 KB (6,149 words) - 13:58, 4 February 2024 |

Homeowner association (section Double taxation) decisions that affect the pace of growth, the quality of life, the level of taxation and the value of land in the community. Most homeowner associations are... 63 KB (7,979 words) - 06:46, 2 April 2024 |

Tax avoidance (section Double taxation) there is a set of bilateral measures pursued thorough treaties or double taxation agreements (DTAAs), this can be done via various clauses. Courts around... 70 KB (8,653 words) - 18:28, 11 March 2024 |

Capital gains tax (section Individual taxation) leaving Hong Kong can incur double taxation on the unrealized capital gains of their vested shares. The Hong Kong taxation of capital gains on employee... 103 KB (13,753 words) - 08:39, 8 May 2024 |

| liable to pay tax more than once on the same income. New Zealand has double taxation agreements with various countries that set out which country will tax... 27 KB (3,077 words) - 04:12, 4 April 2024 |

| Loan-out corporation (section Double taxation) eligible to apply taxation treaty provisions existing between their primary nation of residence and the U.S., and thus avoid double taxation on income received... 15 KB (2,196 words) - 14:22, 8 May 2024 |

| 28 July 2011. "The Double Taxation Relief (Caricom) Order" (PDF). Legal Supplement. 33 (273). 28 December 1994. "No Double Taxation on Earnings Under CSME"... 64 KB (5,508 words) - 12:12, 8 May 2024 |

Pigouvian tax (redirect from Punitive taxation) question for the double dividend hypothesis and the tax interaction literature has been whether the welfare gains from environmental taxation in a second-best... 52 KB (7,327 words) - 21:50, 7 May 2024 |

| List of countries by tax rates (redirect from World taxation) Retrieved 30 May 2017. Tremlett, Giles (2011-12-27). "Andorra gets a taste of taxation". The Guardian. London. Archived from the original on 2012-11-20. Retrieved... 138 KB (5,475 words) - 16:39, 5 May 2024 |

Taxation represents the biggest source of revenues for the Peruvian government (up to 76%). For 2016, the projected amount of taxation revenues was S/... 8 KB (1,041 words) - 18:10, 19 August 2023 |

form a separate layer of tax environment that augments the Code. Double taxation of dividends is completely eliminated when a Russian shareholder owns... 56 KB (7,322 words) - 01:03, 28 April 2024 |

provided by non-distortionary taxes or through taxes that give a double dividend. Optimal taxation theory is the branch of economics that considers how taxes... 110 KB (14,322 words) - 02:57, 1 May 2024 |

Individual retirement account (section Double taxation) appropriate withdrawal taxes and penalties) and may not be replaced. Double taxation still occurs within these tax-sheltered investment arrangements. For... 43 KB (5,763 words) - 21:11, 9 February 2024 |

| "No taxation without representation" (often shortened to "taxation without representation") is a political slogan that, though rooted in the Magna Carta... 77 KB (9,374 words) - 14:11, 9 April 2024 |

which it is made and others. Argentina has agreements on avoidance of double taxation with countries such as Australia, Austria, Belgium, Bolivia, Brazil... 8 KB (1,050 words) - 17:38, 1 November 2023 |

Multiple citizenship (redirect from Double citizenship) income, although U.S. tax law provides measures to reduce or eliminate double taxation issues for some, namely exemption of earned income (up to an inflation-adjusted... 146 KB (17,757 words) - 09:06, 14 April 2024 |

investments by eliminating double taxation. Under the X Tax, financial transactions and instruments are not subject to taxation for both individuals and... 4 KB (396 words) - 18:08, 8 May 2024 |