The Revenue Act of 1861, formally cited as Act of August 5, 1861, Chap. XLV, 12 Stat. 292, included the first U.S. Federal income tax statute (see Sec... 12 KB (1,543 words) - 15:51, 5 August 2023 |

The Revenue Act of 1862 (July 1, 1862, Ch. 119, 12 Stat. 432), was a bill the United States Congress passed to help fund the American Civil War. President... 9 KB (1,238 words) - 22:10, 1 June 2023 |

one of the Townshend Acts Revenue Act of 1861 Revenue Act of 1862 Revenue Act of 1894, known as the Wilson–Gorman Tariff Act War Revenue Act of 1898... 1 KB (194 words) - 16:31, 3 May 2023 |

Day conflicted. Federal income tax was briefly introduced with the Revenue Act of 1861 to help fund the Civil War, and subsequently repealed, re-adopted... 18 KB (1,814 words) - 10:32, 6 April 2024 |

proportion to the Census population of each state. Federal income tax was first introduced under the Revenue Act of 1861 to help pay for the Civil War. It... 25 KB (3,878 words) - 09:32, 10 October 2023 |

| Sixteenth Amendment to the United States Constitution (redirect from Sixteenth Amendment to the Constitution of the United States) although Congress had often imposed excise taxes on various goods. The Revenue Act of 1861 had introduced the first federal income tax, but that tax was repealed... 45 KB (6,207 words) - 20:57, 21 February 2024 |

| first income tax in the Revenue Act of 1861 to help pay for the American Civil War. Tax resisters come from a wide range of backgrounds with diverse... 16 KB (1,854 words) - 05:09, 10 March 2024 |

United States government issues the first income tax as part of the Revenue Act of 1861 (3% of all incomes over US$800; rescinded in 1872). The U.S. Army... 35 KB (3,853 words) - 03:22, 9 April 2024 |

tax in 1861. It was part of the Revenue Act of 1861 (3% of all incomes over US$800; rescinded in 1872). Congress also enacted the Revenue Act of 1862,... 55 KB (7,265 words) - 15:21, 16 November 2023 |

Morrill Tariff (redirect from Morrill Tariff of 1861) the revenue needs of the Civil War and was quickly raised by the Second Morrill Tariff, or Revenue Act of 1861, later that Fall. In its first year of operation... 39 KB (5,605 words) - 23:55, 12 February 2024 |

| Taxation in the United States (redirect from Tax law of the United States) Hellerstein, p. 928. Hellerstein, p. 431. Revenue Act of 1861, sec. 49, ch. 45, 12 Stat. 292, 309 (Aug. 5, 1861). "Pollock v. Farmers' Loan and Trust Company"... 107 KB (13,626 words) - 13:05, 5 April 2024 |

| Revenue Act of 1862, creating the office of Commissioner of Internal Revenue and enacting a temporary income tax to pay war expenses. The Revenue Act... 71 KB (7,590 words) - 23:16, 15 April 2024 |

Poll tax (redirect from Poll Tax Act 1691) e., indirect taxes). The Revenue Act of 1861 established the first income tax in the United States, to pay for the cost of the American Civil War. This... 46 KB (5,773 words) - 17:59, 2 April 2024 |

Income tax (redirect from Criticisms of income taxation) Tracing the Common Roots of Divergent Approaches. Cambridge University Press. pp. 28–29. ISBN 9781139502597. Revenue Act of 1861, sec. 49, ch. 45, 12 Stat... 44 KB (5,150 words) - 16:37, 8 March 2024 |

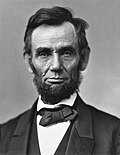

| Abraham Lincoln (redirect from 16th President of the United States of America) tax. In 1861, Lincoln signed the second and third Morrill Tariffs, following the first enacted by Buchanan. He also signed the Revenue Act of 1861, creating... 202 KB (22,569 words) - 12:10, 14 April 2024 |

Laissez-faire (redirect from Economic theory of natural liberty) government imposed its first personal income tax on 5 August 1861 as part of the Revenue Act of 1861 (3% of all incomes over US$800; rescinded in 1872). Following... 89 KB (10,482 words) - 11:24, 5 April 2024 |

First Battle of Bull Run in July, Congress passed the Revenue Act of 1861, which imposed the first federal income tax in U.S. history. The act created a... 31 KB (4,100 words) - 02:02, 14 February 2024 |

| American Civil War (redirect from Civil War of 1861 to 1865) States Notes by the Legal Tender Act of 1862, and the ending of slavery in the District of Columbia. The Revenue Act of 1861 introduced the income tax to... 254 KB (28,747 words) - 18:39, 13 April 2024 |

Pollock v. Farmers' Loan & Trust Co. (category United States Supreme Court cases of the Fuller Court) passage of the Revenue Act of 1861. The act created a flat tax of three percent on incomes above $800 ($27,100 in current dollar terms). The taxation of income... 22 KB (2,873 words) - 04:21, 17 September 2023 |

| Townshend Acts (redirect from Revenue Act of 1767) often listed: The Revenue Act 1767 passed on 29 June 1767. The Commissioners of Customs Act 1767 passed on 29 June 1767. The Indemnity Act 1767 passed on... 57 KB (6,158 words) - 21:21, 20 March 2024 |

Telegraph Act of 1860, Sess. 1, ch. 137, 12 Stat. 41 March 2, 1861: Morrill Tariff, Sess. 2, ch. 68, 12 Stat. 178 August 5, 1861: Revenue Act of 1861, Sess... 48 KB (2,928 words) - 18:10, 5 January 2024 |

| Progressive tax (redirect from Economic effects of progressive taxation) President Abraham Lincoln, and replaced the Revenue Act of 1861, which had imposed a flat income tax of 3% on annual incomes above $800. The Sixteenth... 56 KB (6,532 words) - 18:31, 4 April 2024 |

United States government issues the first income tax as part of the Revenue Act of 1861 (3% of all incomes over US$800; rescinded in 1872). The U.S. Army... 28 KB (2,149 words) - 07:10, 19 February 2024 |

| John Sherman (category Opposition Party members of the United States House of Representatives from Ohio) the Revenue Act of 1861, which imposed the first federal income tax in American history. Sherman endorsed the measure, and even spoke in favor of a steeper... 108 KB (13,295 words) - 02:12, 16 March 2024 |

| The Revenue Act 1766 (6 Geo. 3. c. 52) was an Act passed by the Parliament of Great Britain in response to objections raised to the Sugar Act 1763. The... 2 KB (86 words) - 23:26, 26 February 2024 |