Corporate haven (redirect from Corporate tax haven) S. corporates execute tax inversions (see § Bloomberg Corporate tax inversions). Since the first U.S. corporate tax inversion in 1982, Ireland has received... 213 KB (19,767 words) - 15:39, 26 April 2024 |

| Medtronic (category Tax inversions) low corporation tax regime. Medtronic's tax inversion is the largest tax inversion in history, and given the changes in the U.S. tax-code in 2016 to block... 54 KB (4,640 words) - 06:47, 9 May 2024 |

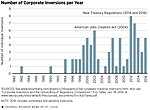

legal headquarters from a higher-tax home jurisdiction to a tax haven by executing a tax inversion. A "naked tax inversion" is where the corporate had little... 241 KB (24,843 words) - 14:25, 8 May 2024 |

Restaurant Brands International (category Tax inversions) various sheltering techniques to reduce its tax rate to 27.5%. As a high-profile instance of tax inversion, news of the merger was criticized by U.S. politicians... 17 KB (1,519 words) - 15:48, 10 March 2024 |

of companies includes only publicly traded companies, also including tax inversion companies. There are also corporations having foundation in the United... 25 KB (209 words) - 23:29, 15 April 2024 |

of tax burden to non-citizens or non-residents). The tourist industry typically campaigns against the taxes. It is separate from value-added tax and... 10 KB (1,028 words) - 21:33, 11 April 2024 |

Mallinckrodt (category Tax inversions) headquartered in Ireland for tax purposes, its operational headquarters are in the U.S. Mallinckrodt's 2013 tax inversion to Ireland drew controversy when... 49 KB (4,942 words) - 18:48, 22 April 2024 |

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale... 103 KB (13,753 words) - 08:39, 8 May 2024 |

Allergan (category Tax inversions) Allergan plc was created from the 2015 merger and Irish corporate tax inversion of two companies, Irish-based Actavis plc and U.S.-based Allergan, Inc... 37 KB (2,816 words) - 15:01, 4 April 2024 |

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property... 57 KB (6,815 words) - 08:00, 27 April 2024 |

| alphabetically, with total tax revenue as a percentage of gross domestic product (GDP) for the listed countries. The tax percentage for each country... 19 KB (98 words) - 18:14, 7 May 2024 |

Look up Inversion or inversion in Wiktionary, the free dictionary. Inversion or inversions may refer to: Inversion (artwork), a 2005 temporary sculpture... 4 KB (569 words) - 19:51, 5 May 2024 |

AbbVie (section Tax avoidance) not be structured as a tax inversion, and that post the transaction, AbbVie would remain legally domiciled in the U.S. for tax purposes. The company divested... 39 KB (3,327 words) - 07:26, 9 May 2024 |

income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income)... 44 KB (5,150 words) - 16:37, 8 March 2024 |

| Burger King (category Tax inversions) over the practice of tax inversions, in which a company decreases the amount of taxes it pays by moving its headquarters to a tax haven, a country with... 163 KB (14,583 words) - 20:56, 16 April 2024 |

Steris (category Tax inversions) Companies portal Corporate tax inversions to Ireland Ireland as a tax haven Medtronic, another example of US medical device tax inversion to Ireland "STERIS Corp... 11 KB (925 words) - 19:01, 21 March 2024 |

| Taxation in Sweden (redirect from Tax in Sweden) tax. The employer makes monthly preliminary deductions (PAYE) for income tax and also pays the payroll tax to the Swedish Tax Agency. The income tax is... 19 KB (2,018 words) - 20:16, 29 April 2024 |

| Perrigo (category Tax inversions) Ireland for tax purposes, which accounts for 0.60% of net sales. In 2013, Perrigo completed the sixth-largest US corporate tax inversion in history when... 28 KB (2,502 words) - 08:37, 9 May 2024 |

Endo International (category Tax inversions) executed a corporate tax inversion to Ireland to avoid U.S. corporate taxes on their U.S. drug sales, and to avail of Ireland's corporate tax system. In 1920... 26 KB (2,229 words) - 19:36, 29 February 2024 |

Taxation in Pakistan (redirect from Tax in Pakistan) Tax Ordinance 2001 (for direct taxes) and Sales Tax Act 1990 (for indirect taxes) and administered by Federal Board of Revenue (FBR). The Income Tax Act... 8 KB (991 words) - 11:22, 15 November 2023 |

The income tax threshold is the income level at which a person begins paying income taxes. The income tax threshold equates to the: Personal allowance... 3 KB (235 words) - 01:54, 8 April 2024 |

broad categories: Income tax Payroll tax Property tax Consumption tax Tariff (taxes on international trade) Capitation, a fixed tax charged per person Fees... 13 KB (2,017 words) - 04:22, 26 December 2023 |

Horizon Therapeutics (category Tax inversions) executed a tax inversion to move its legal headquarters to Ireland to avail itself of Ireland's low tax rates and beneficial corporate tax system. In... 15 KB (1,255 words) - 04:14, 23 April 2024 |

of sales taxes levied. These are : Provincial sales taxes (PST), levied by the provinces. Goods and services tax (GST)/harmonized sales tax (HST), a value-added... 11 KB (772 words) - 04:22, 6 April 2024 |

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution... 32 KB (3,778 words) - 08:55, 9 May 2024 |

An ad valorem tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed... 28 KB (4,337 words) - 22:45, 28 March 2024 |

Tax amnesty allows taxpayers to voluntarily disclose and pay tax owing in exchange for avoiding tax evasion penalties. It is a limited-time opportunity... 30 KB (3,632 words) - 03:34, 27 February 2024 |